Medicare Supplement plans, also known as Medigap plans, are additional insurance policies that help cover the costs that Original Medicare (Part A and Part B) does not pay for. In simple terms, they fill the “gaps” in your Medicare coverage. Due to their comprehensive coverage and flexibility, Medicare Supplement plans are our top recommendation for additional coverage. Scroll down to learn more about Medicare Supplements and why they are our first choice.

Medicare Supplements provide you with optimal coverage.

Hospital and Medical Coverage

Medicare supplements, also known as Medigap, stand out as the optimal insurance option for Medicare beneficiaries. Offering comprehensive coverage and minimizing out-of-pocket expenses, these plans support financial peace of mind by filling in the gaps left by Original Medicare. By covering expenses like deductibles, coinsurance, and copayments, beneficiaries can confidently plan their healthcare expenses and avoid unexpected financial burdens.

No Network Restrictions

A key advantage of Medicare Supplements is the freedom to choose any doctor or specialist who accepts Medicare, which allows beneficiaries to receive care without network restrictions or the need for referrals. Members gain access to a wide range of healthcare providers nationwide, ensuring they receive the care they need, when and where they need it.

No Surprises

Medicare supplements offer predictable out-of-pocket costs, as they cover expenses not paid by Original Medicare, such as deductibles, coinsurance, and copayments. This financial predictability can be highly beneficial for individuals on fixed budgets or those who prefer to plan their healthcare expenses in advance.

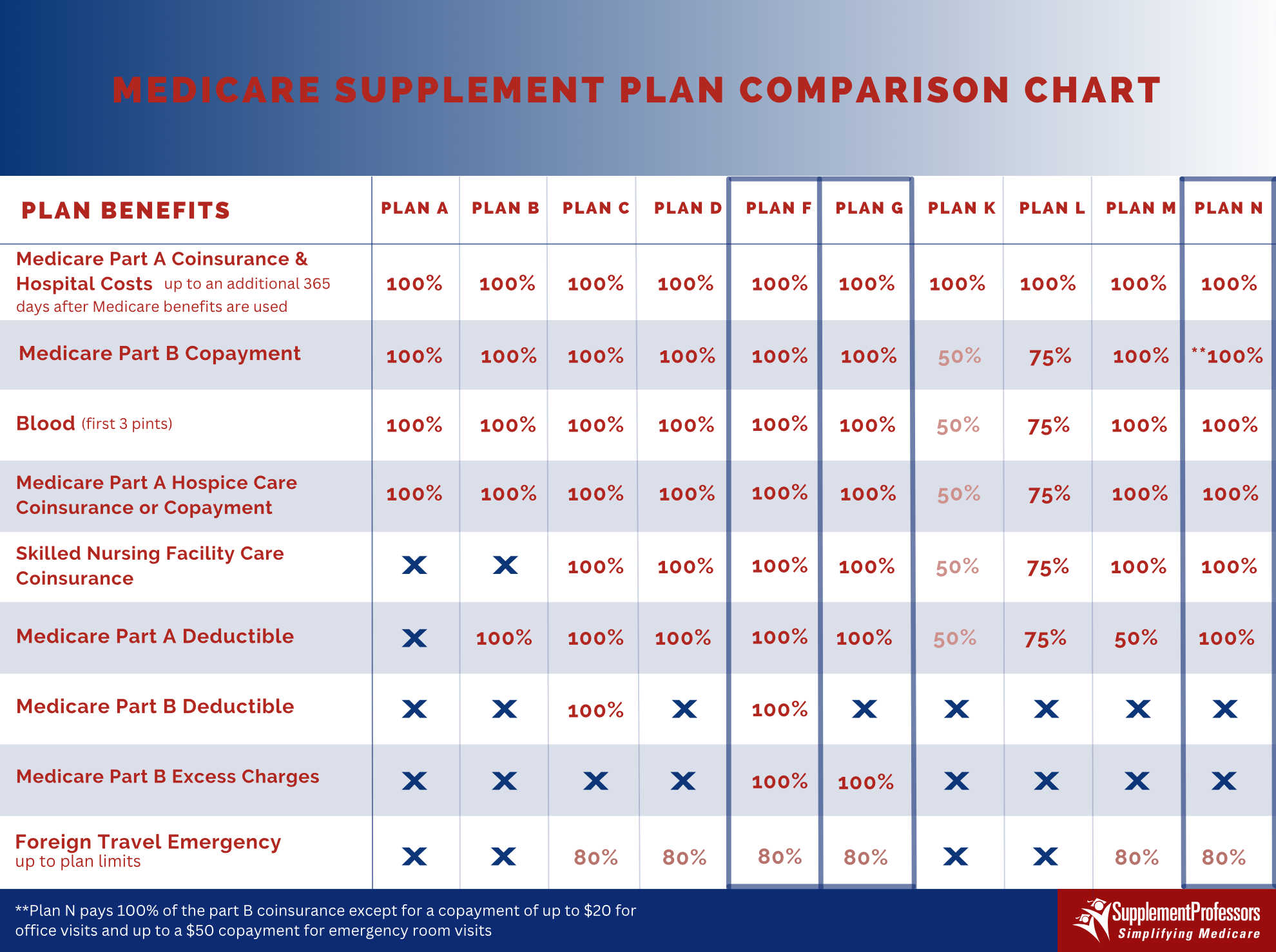

Types of Plans

There are 10 standardized Medicare Supplement (Medigap) plans labeled with letters A, B, C, D, F, G, K, L, M, and N. Each plan provides different levels of coverage, but the benefits within each plan are standardized across all insurance companies. In other words, Plan F from one insurance company will have the exact same benefits as Plan F from another insurance company.

Important questions to consider when choosing a plan:

What will my premium be when I get older? In 5 years? In 10 years?

Some companies premiums automatically adjust by age. Other companies automatically increase your premium for the first 6 years you have the policy. Unfortunately, this is not always told to the consumer up front. We can help you understand your future costs and prevent any unpleasant surprises down the road.

Why do some insurance companies charge so much more than other companies for the same coverage?

There are several reasons for the enormous price differences you may see across companies. Some factors include age, health, marital status, and geographic location.

Is there another company that offers the exact same coverage at a substantially lower price?

There is a very good chance that the answer is yes! We can give you competitive price quotes from the leading companies. Call us today or click here to request a quote.

Does my plan offer electronic crossover?

Some major companies do not. Electronic crossover prevents hassle and paperwork for you. We can tell you whether the plan you select has this important feature.

Does the company I select have strict underwriting?

This can be an issue even if you are guaranteed to be accepted, since companies with lenient underwriting will likely incur more claims payments in the future. More claims payments usually result in higher monthly premiums, even for healthy members of the plan.

Should I enroll through Supplement Professors or direct through an insurance company?

We represent multiple companies, whereas an insurance company will only be able to recommend its own plans, even if they are overpriced or offer inferior coverage to the next company. Furthermore, if you go through Supplement Professors, you will have us as a resource for any insurance help you require in the future. Regardless of whether you enroll through us or direct through an insurance company, your premium cost will be exactly the same. This is mandated by law.